Trusted by 2,800+ Leading Industry Companies

Metalshub Benefits

Why Metalshub?Why Metalshub?

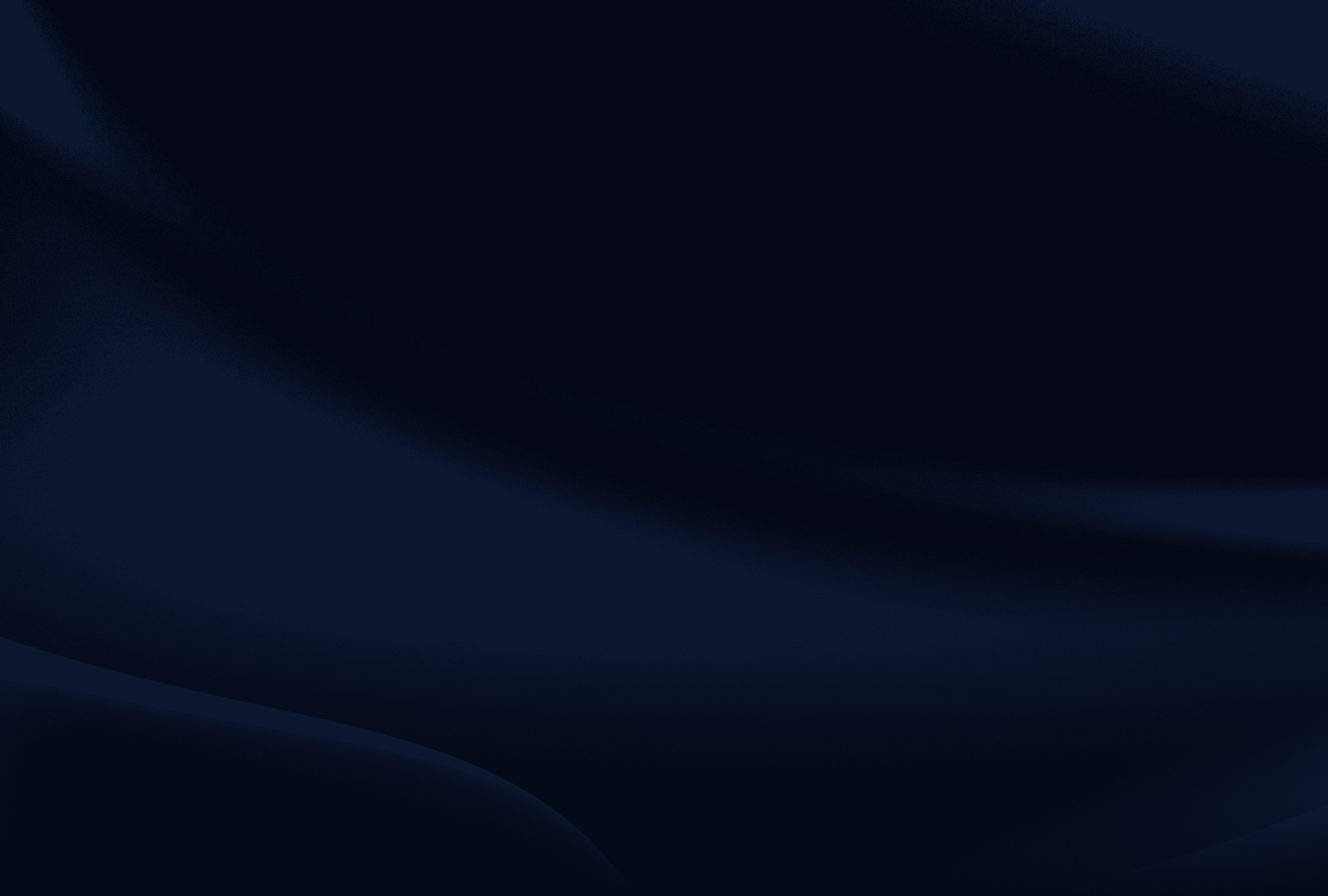

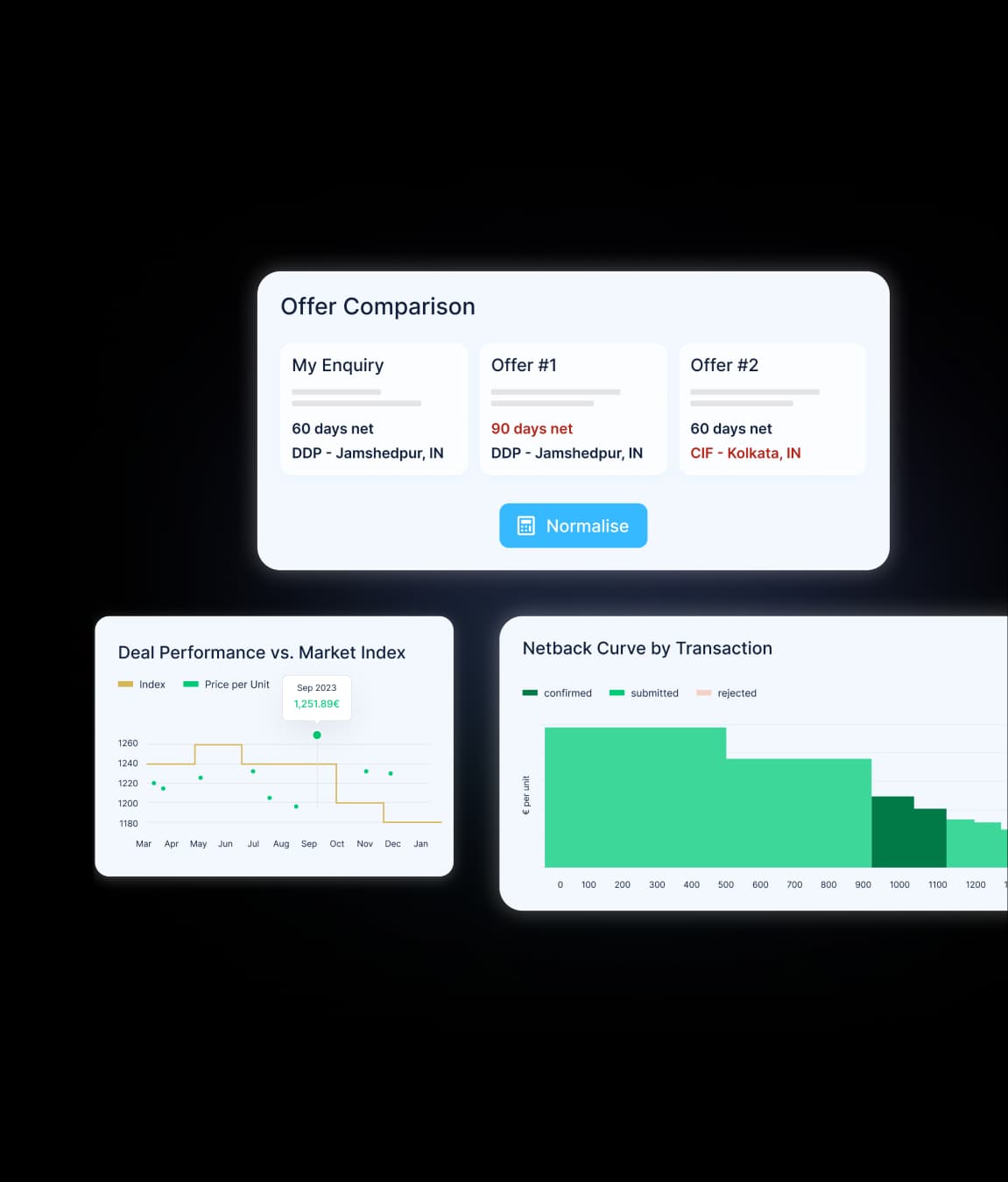

Reduce Raw Material Cost

Connect with new suppliers, conduct effective negotiations and take data-driven driven decisions to save direct raw material cost. On average companies

- Save 2.3% in costs

- Discover 9 new suppliers

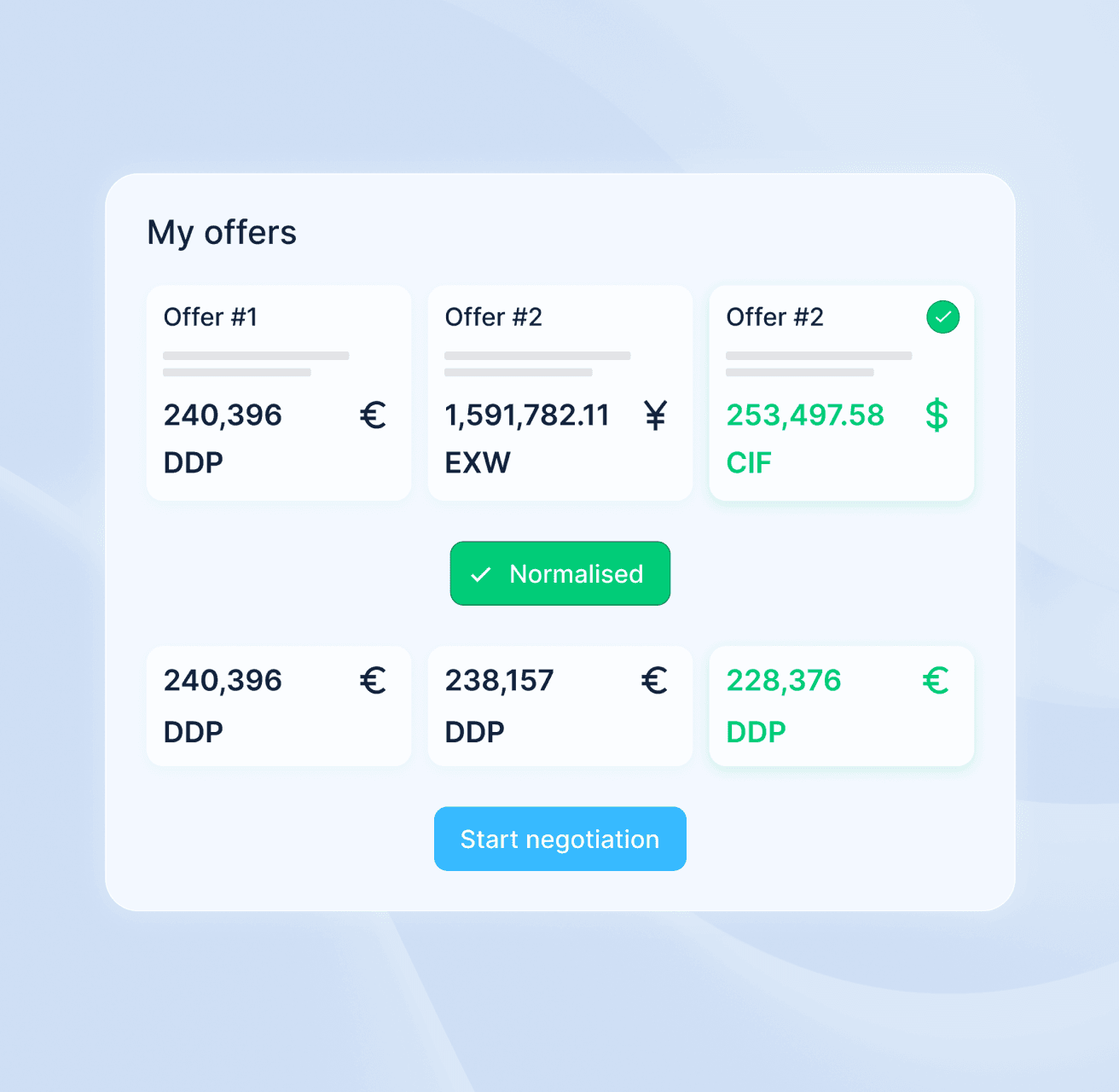

Optimise Raw Material Sales

Simplify enquiry-to-contract, run auctions, discover new customers and allocate the most suited inventory to optimise your netback across offers. On average companies

- Discover 3 new customers

- Onboard in 4 weeks

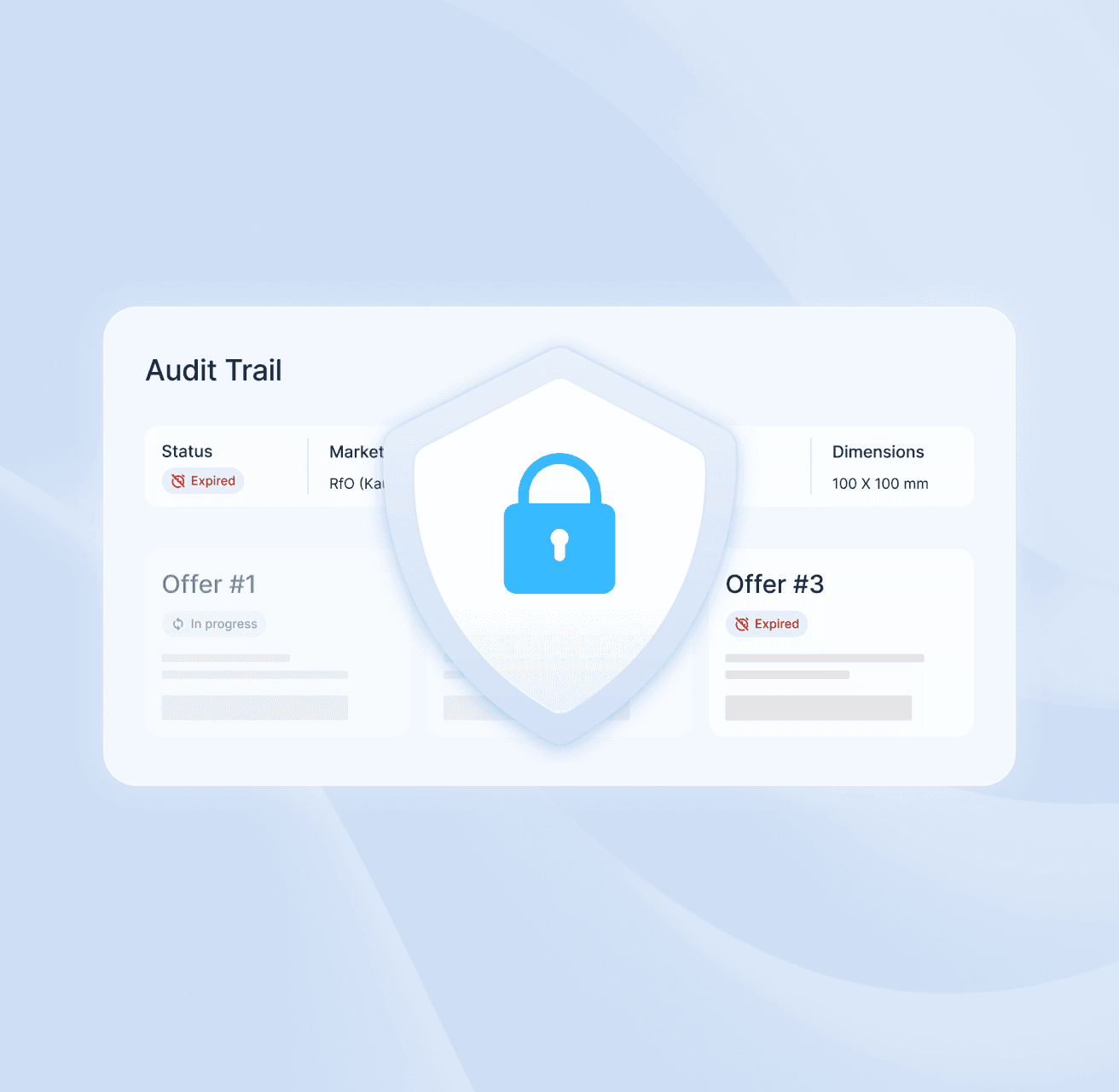

Ensure 100% Compliant Trading

Capture all interactions and integrate approval workflows to reduce risk and ensure audit-readiness.

- Documented negotiations

- Multi-entity and group oversight

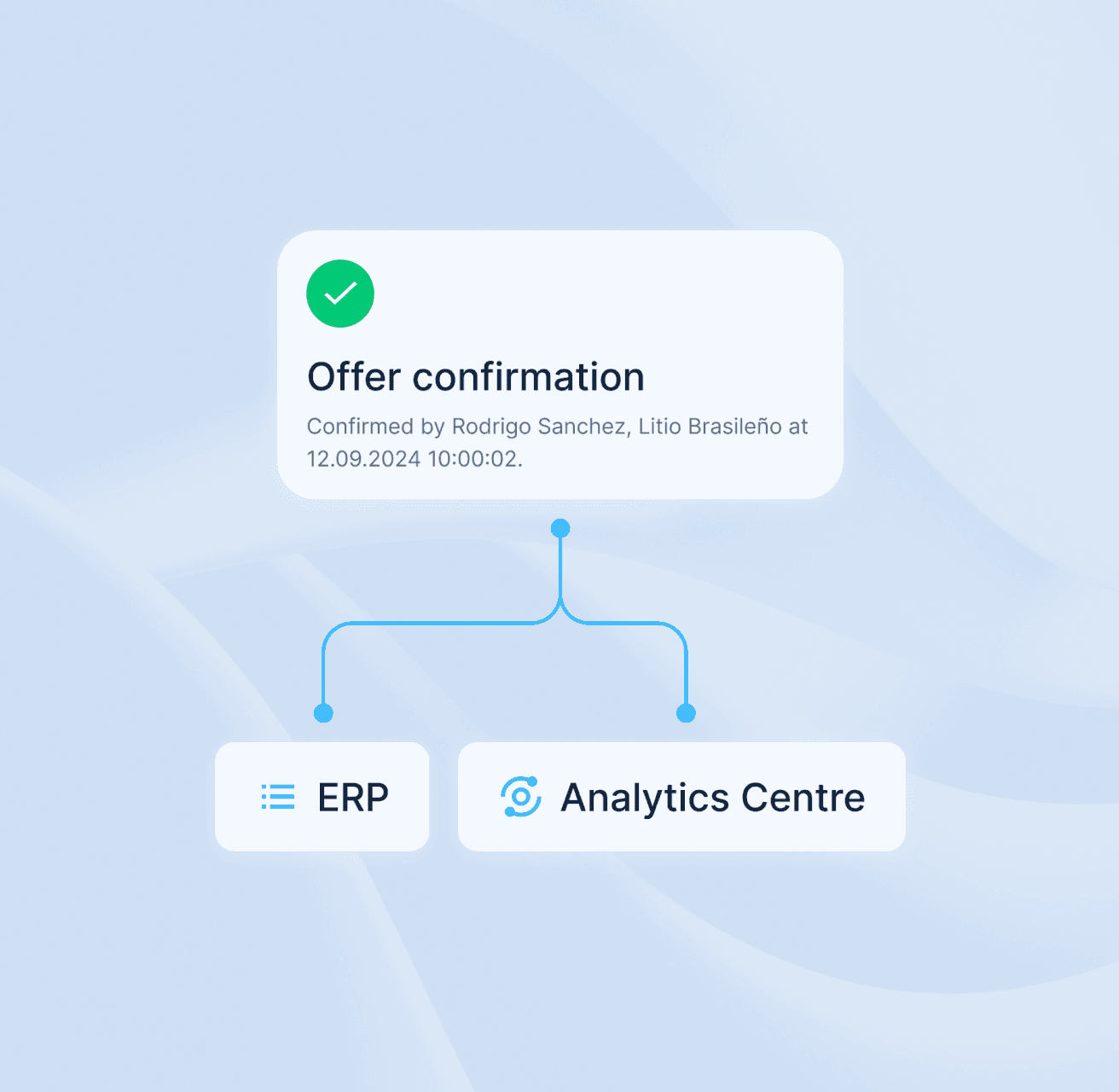

Remove Process Inefficiencies

Speed up your source-to-contract or sales process, simplify data analyses, and integrate into your ERP to reduce admin overhead costs.

- Seamless ERP integrations

- Automated workflows

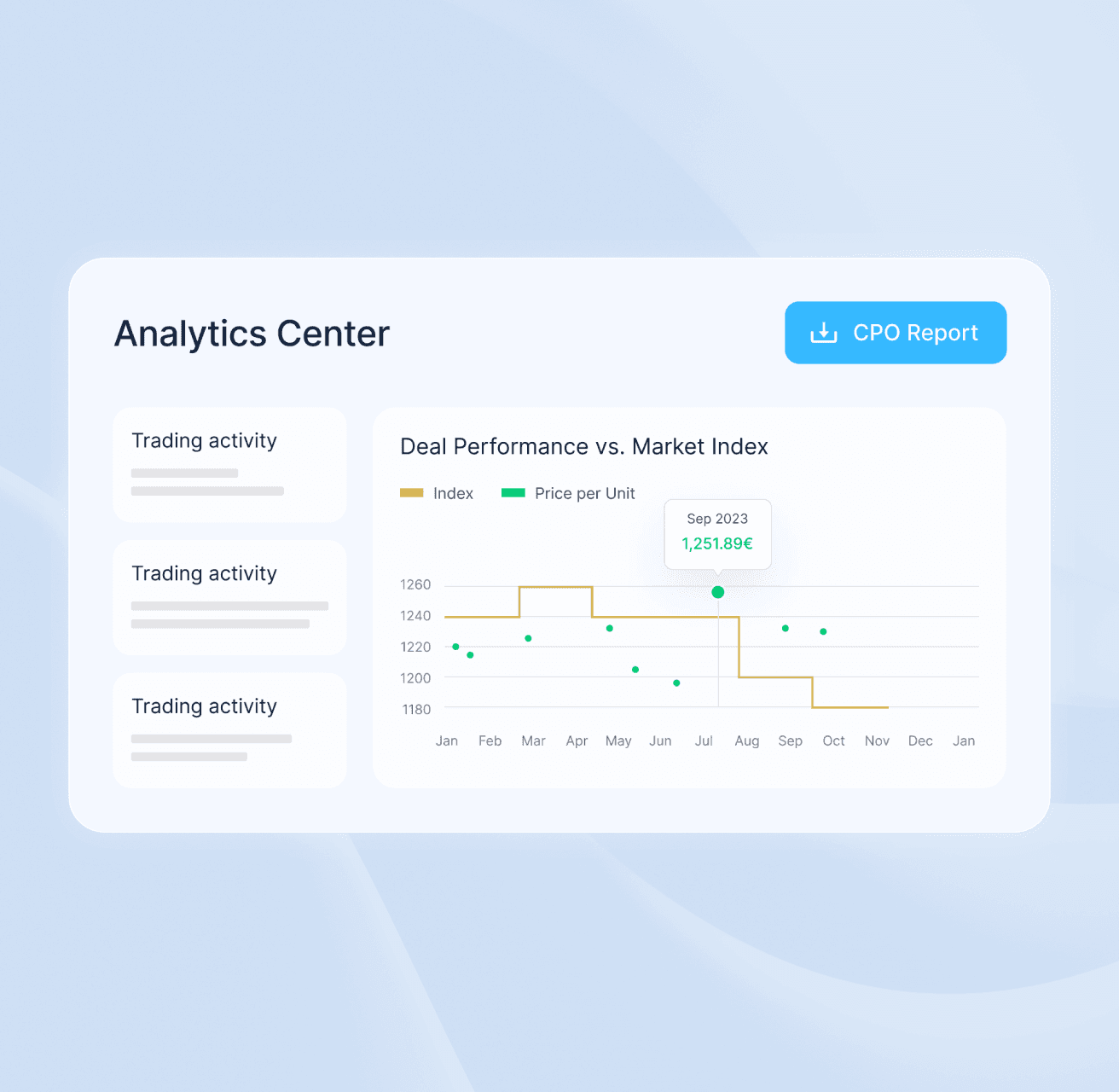

Leverage Data

Access real-time, structured, and analysable procurement, sales and contract data to take informed decisions.

- Automated executive reporting

- Tailored dashboards

ALL-In-ONE

Software for All Your NeedsSoftware for All Your Needs

Tailored software solutions for metals, mining, and recycling unlocking efficiency, transparency, and growth across industries.

Steel Scrap

Iron Ore

Coke

Alloyed Scrap

Ferroalloys

Limestone

Steel Scrap

Pig Iron

Alloyed Scrap

Ferroalloys

Limestone

Refractories

Alumina

Magnesia

Chamotte

Bauxite

Binder

Cement

Lithium

Copper

Nickel

Minerals

Ferroalloys

Aluminium

Steel Scrap

Batteries

E-Scrap

Alloyed Scrap

Copper Scrap

pCAM

Molybdenum

Silicon

Chrome

Nickel

Titanium

Manganese

Scrap

Base Metals

Ferroalloys

Industrial Minerals

Battery Materials

Coke

Molybdenum

Copper

Scrap

Lithium

Graphite

pCAM

CUSTOMER SUCCESS STORIES

What Users Say About UsWhat Users Say About Us

Want to learn more?

See how Metalshub can optimise your sales and procurement of raw materials. Get in touch for a personalised quote and arrange a demo today!

Get the Latest Updates